Why Choose Ar Tax

-

1200+

Clients Worldwide

-

4.8+

Customer Rating

-

5+

Years’ Experience

-

24*7

Quick Support

Benefits of income tax return filing in jaipur

If you are not in the income tax bracket. You should still file returns because filing an Income Tax Return (ITR) can bring you several benefits. Below are 5 advantages of income tax return filing in jaipur:

Easier Loan Approval: Banks and financial institutions accept income tax returns as proof of your income. When applying for a bank loan, they often request ITR documents. Regular ITR filing in jaipur makes it easier for you to get loans from banks and other financial institutions.

Claiming Tax Refunds: Without filing Income Tax Return, you can't claim back the tax deducted from your income, even if your income falls within the basic exemption limit. Filing Income Tax Return is compulsory to claim tax refunds. When you file an ITR, the Income Tax Department assesses it.

If after ITR filing in jaipur, they is any refund eligibility and the refund will be credited directly in your bank account.

Essential for Visa Application: Some countries' visa authorities may ask for 3 to 5 years of ITR as proof of financial status when you apply for a visa to travel abroad.

Carrying Forward Losses: If you invest in shares or mutual funds and incur losses, filing Income Tax Returns within the specified time limit allows you to carry forward these losses to the next year. ITR classifies for tax benefits on profits and also helps in offsetting the gains in the next year.

Acts as Address Proof: The ITR receipt is sent to your registered address and can serve as proof of address. ITR receipts also serves the purpose of income proof.

Documents Required for Income Tax Return Filing in jaipur

The necessary documents for ITR filing in jaipur:

PAN Card: Your Personal Identification Number is used by the Income Tax Department for identification purposes.

Bank Statement: Details of your bank account transactions and financial activities.

Interest Certificate from Banks or Post Office: Proof of interest earned from investments made in banks or post offices.

Proof of Tax-Saving Investments: Details of investments eligible for tax deduction, such as life insurance policies, PPF, etc.

Form 16 (For Salaried Individuals): It provides details of your salary issued by your employer.

Salary Slip: It contains details of your salary and financial information provided by your employer.

TDS Certificate: If tax has been deducted from your income, this certificate provides information about the tax deduction.

Form 16A/16B/16C: These provide evidence of financial transactions issued by the Income Tax Department.

Form 26AS: It contains details of tax credits deposited with the Income Tax Department for tax distribution.

How many Categories of Income Tax Returns Forms?

In our country India, there are various categories of Income Tax Return (ITR) forms, each of the category caters different types of taxpayers and income sources. As of my last update in January 2024, there were seven main categories of ITR forms:-

ITR-1 (Sahaj):

For those individuals who have their income from salaries, one house property, or some other sources (excluding winnings from lottery and income from race horses), and their total income should be up to Rs. 50 lakh.

-

ITR-2:

For those individuals and Hindu Undivided Families (HUFs), those doesnot having income from gains and profits of profession or business.

-

ITR-3:

For those individuals and Hindu Undivided Families (HUFs) who have their income from profits and gains of business or profession.

-

ITR-4 (Sugam):

ITR 4(Sugam) is for those who have presumptive income from business and profession.

-

ITR-5:

ITR 5 is for those persons other than individuals, company, Hindu Undivided Family (HUF) and person who is filing Form ITR-7.

-

ITR-6:

ITR 6 is for those companies which doesnot claim exemption under section 11.

-

ITR-7:

ITR 7 is for persons including companies required to furnish their return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) or 139(4E) or 139(4F).

These forms vary in complexity and applicability depending on the taxpayer's income sources and nature of business or profession. Taxpayers need to choose the appropriate form based on their specific financial situation. It's advisable to consult a tax professional or refer to the latest guidelines from the Income Tax Department for accurate filing.

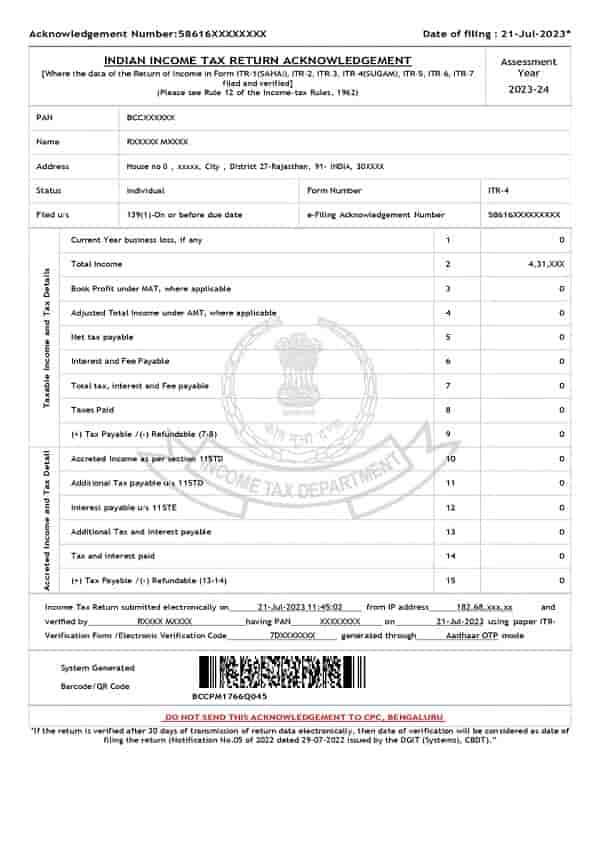

Sample of Income Tax Return certificate

Procedure to Income Tax Return Filing in jaipur

Gather Documents: Collect all necessary documents such as PAN card, Aadhaar card, bank statements, Form 16, investment proofs, and other relevant financial documents.

Calculate Income and Taxes: Calculate your total income from all sources and determine your tax liability. Consider deductions and exemptions applicable to you.

Authenticate Your Return: we send a draft copy of the income tax reten you chek all fundamentals.

Submit the Return: Once verified, submit your return. If filing online, you'll receive an acknowledgment containing your ITR-V (Acknowledgment) form.

Verify Your Return: After filling the form, verify it using Aadhaar OTP, Net banking, or EVC (Electronic Verification Code).

Types of Income Tax Return for jaipur People

Original Return:

An original return refers to the initial income tax return filed by a taxpayer for a particular assessment year. It contains the taxpayer's income details, deductions, and tax liability calculated based on the provisions of the Income Tax Act applicable for that assessment year.

Revised Return:

A revised return is filed when a taxpayer discovers any errors or omissions in the original return filed for an assessment year.

Taxpayers can file a revised return to correct mistakes in income, deductions, or taxes paid.

Taxpayer can file revised returns within the specified frame of time, which is usually before the end of specific

assessment year or before the completion of that assessment year, whichever comes earlier.

Belated Return:

A belated return is filed when a taxpayer fails to file the original return within the due date specified under the Income Tax Act. In such cases, taxpayers can still file their returns, but it is considered belated. There are certain consequences and penalties associated with filing belated returns, including interest on any tax payable and limitations on carry forward of losses.

Who needs to file an income tax return in jaipur?

If you live in jaipur and your total income exceeds 2.5 lakh rupees per annum, you are required to file Income Tax Return (ITR).

The tax amount you need to pay will depend on your age and the tax regime you choose. In the 2020 budget,

the Central Government introduced a new tax regime with different tax slabs compared to the old tax regime. However,

individuals have the option to choose between the old tax regime and the new one. The applicable tax rates will vary based on

the tax regime you select. Below is a table explaining the tax rates for both tax regimes.

Based on below table option, one can compare both the tax regimes and select the one that suits best to them.

Income Tax Department has made ITR filing in jaipur completely online.

The E-filing utility by Income Tax Department has made it smooth for the taxpayer that they can register on Income Tax Portal and also

report thier income for any particulat financial year and later submit their income tax return online.

Pan Card and Aadhar card details can be used to register on the Income tax portal to file Income tax return.

For filing of Income tax return, Income under the below sources is calculated :

1. Income from Business/ Profession

2. Income from Salary

3. Income from House Property

4. Income from Capital Gains

5. Income from Other Sources such as Income from Dividend for share / Commission from any / FD Interest etc.

For filing of Income tax – the total taxable income from the above sources is reported through different ITR Forms.

Income Tax Slab for Income Tax Return filing in jaipur. (FY 2024-2025)

| Income Range (Rs.) | Tax Rate |

|---|---|

| Up to 2,50,000 | No tax |

| 2,50,001 - 5,00,000 | 5% of income exceeding 2,50,000 |

| 5,00,001 - 10,00,000 | Rs. 12,500 + 20% of income exceeding 5,00,000 |

| Above 10,00,000 | Rs. 1,12,500 + 30% of income exceeding 10,00,000 |

Note: A 4% Health and Education Cess is applicable on the total income tax payable.

Why Choose AR Tax for Income Tax Return Filing in jaipur?

Expert Assistance: Our experienced team knows tax laws inside out, ensuring your returns are accurate and compliant.

Simple Process: We make filing stress-free, breaking down complex terms into easy steps for you to follow with ease.

Maximized Savings: Count on us to find all the deductions and credits you're entitled to, saving you money where possible.

Timely Submissions: Relax knowing we'll submit your returns on time, sparing you from late fees and headaches.

Personalized Help: We're here to answer your questions and offer support every step of the way, ensuring you're confident throughout the process.

Choose AR Tax for seamless, efficient, and reliable income tax filing services tailored to your needs.

Top FAQ for Income tax return filing in jaipur

For Small Taxpayers: If the total income does not exceed ₹5,00,000, the maximum late filing fee is capped at ₹1,000.

Interest Charges: In addition to the late filing fee, interest charges may apply on any outstanding tax liability.