Why Choose Ar Tax

-

1200+

Clients Worldwide

-

4.8+

Customer Rating

-

5+

Years’ Experience

-

24*7

Quick Support

GST registration journey in jaipur

GST, or Goods and Services Tax, came into effect in India in July 2017 by indian goverment. It's a single tax that replaced many other taxes.

GST makes things simpler because instead of paying many different taxes,

people and businesses now pay just one tax on goods and services.

With GST registration in jaipur, businesses can navigate through varying tax rates, like 5%, 12%, 18%, and 28%. Some really important things are taxed at 0%.

GST helps businesses save money and makes it easier to do business across India.

Documents required for gst registration in jaipur

-

Individual or sole proprietorship

- Aadhar Card of applicant

- Pan Card of applicant

- Passport Size Photo of applicant

- Scan copy of Electricity bill

- Scan copy of Rent agreement (if Required)

- Scan copy of Consent letter (if Required)

- Scan copy of Bank passbook

-

Partnership firm

- Aadhar Card of authorized person

- Pan Card of authorized person

- Pan Card of Firm

- Passport Size Photo of authorized person

- Scan copy of Electricity bill

- Scan copy of Rent agreement (if Required)

- Scan copy of Consent letter (if Required)

- Scan copy of Bank passbook

- Scan copy of Partnership deed

-

Private Limited Company/ Other

- Aadhar Card of director

- Pan Card of Company

- Passport size photo of director

- Scan copy of Electricity bill

- Scan copy of Rent agreement

- MOA & AOA

- Current account details

- Incorporation Certificate

- Authorization letter

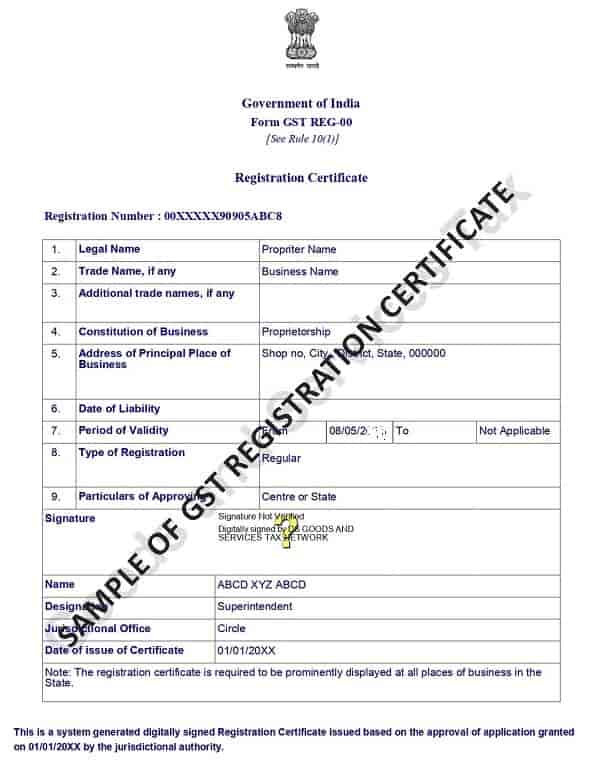

Sample of gst registration certificate

The advantages of GST registration in jaipur

-

Exemption to new traders

New traders often benefit from exemptions, like threshold exemptions, sparing them from GST registration if their turnover falls below specified limits. This saves them from starting tax liabilities and encourages small businesses.

-

Legally recognized as a supplier

GST registration grants legal recognition to traders, enhancing credibility and fostering trust among customers and business partners. It gives business opportunities with the accessibility to a wider market range with the government trust.

-

Lesser tax compliance

GST registration simplifies tax compliance procedures for businesses, reducing administrative burdens and facilitating smoother operations. With GST registration businesses will know all the tax obligations and tax liabilities and can run their business efficiently and for all business owners it is better than indirect taxes and VAT.

-

Simple and straightforward online procedures:

Online procedures for GST registration are designed to be simple and straightforward, making it easy for businesses to complete the process from their computers or smartphones. With user-friendly interfaces and clear instructions, you can fill out forms, submit necessary documents, and track your application status conveniently. Government of India gives us a simplied process for GST registration which saves the time and efforts of everyone without any hassle.

Eligibility criteria for GST registration in jaipur

The eligibility criteria for GST registration in jaipur, as in any part of India, depend on the nature of the business and its turnover. As per the GST law, the following entities are required to register for GST in jaipur:

-

Compulsory registration:

Your annual turnover should exceed the threshold limit set by the government. For most states, including india state where jaipur is located, the threshold limit is Rs. 40 lakhs for small businesses engaged in supplying goods. Additionally, there are specific cases where GST registration is mandatory irrespective of turnover. For example, if you are involved in inter-state supply of goods or services or if you have multiple branches within a state.

-

Inter-State sales:

This pertains to businesses in jaipur involved in taxable transactions across state borders within India. If goods or services are supplied from jaipur to entities located in other states, GST registration is mandatory, ensuring compliance with interstate tax regulations under the GST regime.

-

E-commerce operators:

If you're running an online platform facilitating buying and selling, you need to register for GST. This includes websites and apps where goods or services are traded, ensuring compliance with tax regulations and smooth operation within the GST framework.

-

Non-Resident taxable persons:

If you're living outside India but doing business here, you still need to register for GST. Whether you're supplying goods or services, it's important to comply with tax laws, even if you're not residing in India permanently.

-

Reverse charge mechanism:

Under this rule, if you buy goods or services from specific registered businesses in jaipur, you are responsible for paying the GST directly to the government instead of the supplier. It shifts the tax payment obligation to the buyer rather than the seller.

-

Input service distributors:

When your company receives invoices for services utilized across different branches or units, registering as an Input Service Distributor (ISD) enables you to distribute input tax credit efficiently among these units, simplifying your organization's tax management processes.

-

Tax Deductors at source (TDS):

When you're in charge of deducting tax from specific payments, such as salaries or contractor fees, registering as a Tax Deductor at Source (TDS) is necessary. This ensures adherence to tax regulations and facilitates the accurate deduction and remittance of taxes to the government.

-

Tax Collectors at source (TCS):

If your business involves collecting tax at source, such as in the case of e-commerce transactions, registering as a Tax Collector at Source (TCS) is necessary. This ensures compliance with tax laws and facilitates the proper collection and remittance of taxes to the government.

Types Of GST registration

GST registration in jaipur is 3 type of registarion

-

Regular GST Registration

Regular GST registration refers to the standard type of registration required for businesses in India whose annual turnover exceeds the threshold set by the government. In this type of registration, businesses are required to collect GST on their sales (output tax) and pay GST on their purchases (input tax). They need to file regular GST returns, including GSTR-1 for outward supplies, GSTR-3B for monthly summaries, and GSTR-9 for annual filings.

Registered businesses can claim input tax credit on their purchases, reducing their overall tax liability. They can also engage in interstate transactions and avail various benefits under the GST law. Maintainig daily transaction records, issuing tax invoices and folllowing statutory obligation comes under GST compliance. If you don't follow the rules, you could face penalties and legal trouble.. Regular GST registration ensures that businesses adhere to the GST law and contribute to the tax system effectively. -

Composition scheme registration

Composition Scheme Registration offers a simplified tax compliance option for small businesses. Under this scheme, eligible businesses can pay a fixed percentage of their turnover as GST and file quarterly returns. This scheme is created to minimize the compliance burden for small taxpayer and it also encourages them to participate in formal economy.

Note: However, businesses opting for the composition scheme cannot claim input tax credit. -

Voluntary GST registration

Voluntary GST registration is an option for businesses to register for GST even if their turnover falls below the mandatory threshold. It increases their credibility and also enables businesses to get involved in interstate transactions, avail input tax credit. By this business can streamline tax compliance processes and also expand their market reach. Voluntary GST Registration facilitates access to various benefits under the GST framework, contributing to overall business growth and development.

Discover effortless GST registration in jaipur with Ar Tax

c Looking for seamless GST registration in jaipur? Look for Ar Tax. Our dedicated team of experts ensures hassle-free GST registration in just 7 business days:

Step 1: Connect with our team. Our proficient GST expert guarantees a hassle-free registration process.

Step 2: Share all necessary documents directly with our experts.

Step 3: Our GST expert initiates the registration process online, ensuring a smooth experience.

Step 4: Receive your GSTIN and GST registration certificate.

Experience your GST registration in jaipur with AR tax smoothly.

What are the different rates in GST?

The Goods and Services Tax (GST) in India is catered or structured with various tax rates based on the nature of goods and services. As of the latest update, GST rates include:

-

Exempted:

Essential Goods and Services that are vital for livelihood and societal welfare are exempted under the Goods and Services Tax regime by the government of India. Examples for the same are fresh fruits, vegetables,milk, healthcare, and educational services.

Purpose of exempted GST is to ensure that basic needs or necessities remain accessible to everyone without the additional burden of tax liability. It ensures the sustaining the well being and education of citizens with equal fundamental rights. -

5% Tax Rate:

Items falling under this slab include household necessities, packaged food items, essential drugs, and transportation services such as railways and air travel in economy class.

5% Tax Rate for goodsGoods falling under the 5% GST slab include essential items like grains, pulses, sugar, and medical supplies, alongside educational materials, newspapers, and economy-class airfare. This tax rate focuses on balancing affordability and growth generation, acknowledging the significance of these goods in daily life and education. By keeping taxes at 5%, the government aims that these essentials remain accessible while contributing to the overall tax revenue generation for public services and infrastructure development in the country.

5% Tax Rate for serviceServices under the 5% GST slab include essential categories like transportation in economy class, including railway tickets and domestic air travel. 5% GST is levied upon healthcare services and lodging in the budgeted hotels from 0 star to 3 star. This rates aims at making important services affordable and also contributes to the government's revenue generation for development and public welfare initiatives.

-

12% Tax Rate:

12% GST slab caters number of good and services:

12% Tax Rate for goods1. Processed food items such as frozen meat products, packaged cheese, butter, and ghee.

12% Tax Rate for service

2. Certain household items like fans, electrical transformers, and water heaters.

3. Clothing made from synthetic fibers, excluding luxury garments.

4. Mobile phones and accessories, falling outside the higher tax bracket.

5. Stationery items, excluding those of luxury nature.1. Business class air travel.

2. Accommodation in hotels with tariffs below a certain limit.

3. IT services like software development and system integration.

4. Construction services for non-luxury residential complexes.

5. Indoor catering services, excluding those provided in air-conditioned restaurants. -

18% Tax Rate:

Under the 18% GST tax rate, various goods and services are subject to this moderate tax bracket catering semi-luxury products:

18% Tax Rate for goods1. Packaged snacks and confectionery items.

18% Tax Rate for service

2. Non-essential household items like furniture and mattresses.

3. Self care products such as cosmetics and toiletries.

4. Certain electronic goods like cameras, monitors, and printers.

5. Certain types of footwear, excluding luxury brands.1. Restaurants serving food and beverages in air-conditioned premises.

2. Outdoor catering services.

3. Financial services such as banking, insurance, taxation and stockbroking.

4. Telecommunication services including mobile phone bills and internet subscriptions.

5. Travel services such as hotel accommodation in mid-range establishments. -

28% Tax Rate:

Under the 28% GST tax rate, goods and services that are considered non-essential or luxury items fall within this category, reflecting a higher tax bracket aimed at discouraging excessive consumption while generating substantial revenue.

28% Tax Rate for goods1. Luxury automobiles, including high-end cars and motorcycles.

28% Tax Rate for service

2. Tobacco products such as cigarettes and cigars.

3. Aerated drinks containing added sugar or sweeteners.

4. High-end consumer electronics like TVs, refrigerators, and washing machines.

5. Premium alcoholic beverages like imported wines and spirits.1. 5-star hotel accommodation and luxury resorts.

2. Fine dining restaurants and eateries offer premium dining experiences.

3. Spa and wellness services provided in esteemed establishments.

4. Entertainment services such as amusement parks, cinemas, and concerts.

5. Luxury travel experiences including premium air travel and luxury cruise packages.

Although 28% tax rate is a major contributor to generate revenue for initiatives and schemes also, on the other hand it aims to discourage the consumption of luxury goods and services.